Zugswag-End Game

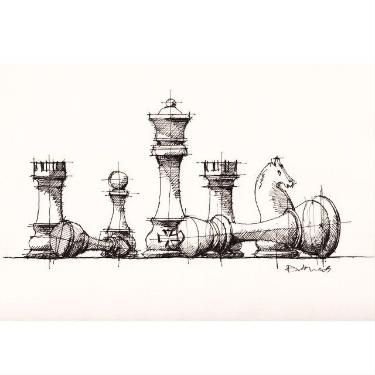

The world, at this hour, is perceived not with the wide-eyed gaze of discovery, but with the weathered patience of a player who has watched the board grow familiar, then stark, then heavy with implication. We are beyond the era of grand openings, of flamboyant gambits played for psychological effect. The pieces have been traded, the center has been contested, and the remaining forces are arrayed in formations of delicate, almost excruciating balance. This is the quiet agony of the endgame: where every move is a concession, every advance a potential weakening, and the clock ticks not with urgency, but with grave, metronomic finality.

I have been watching as one watches a table long after the spectators have drifted away, when the only sound is the faint click of wood on felt, and the players are no longer playing to win so much as they are playing not to lose. The early bravado has bled away into the felt. What remains is the architecture of past decisions. The leveraged positions, the deferred compromises, the promises stretched thin across time like aging parchment... The room is quiet because everything audible now carries weight. Every sigh, every hesitation, becomes data.

This does not feel like a pivot, nor a crisis in the classical, clamorous sense. It feels like a gradual, inexorable compression. A corridor that has been narrowing with such subtlety that one only notices the walls when they brush both shoulders. The air itself feels dense with concluded things.

In chess, the term Zugzwang describes that exquisite, cruel condition where the obligation to move is the greatest threat. All possible moves degrade the position. The danger lies not in the opponent’s attack, but in the board’s unforgiving memory. It remembers every overextension, every pawn pushed too far, every piece placed for tempo rather than permanence. In such a state, action does not create possibility; it extinguishes it. To move is to lose, yet not to move is to forfeit. This is the essence of strategic exhaustion.

We are there…

For generations, the operating logic was expansion, growth could outpace error, and debt remained a theoretical construct, endlessly refinanced against a future of perpetual ascent. Complexity was not a risk but a shield, a diffusion mechanism that made systemic failure seem obsolete. Confidence flowed like a solvent, greasing the gears of politics and markets, allowing structures to hold shapes that defied gravity.

That confidence has not evaporated; it has crystallized. It is no longer a fluid medium but a brittle asset, carefully measured and deployed. It is rationed…

It smells like hot metal grinding its gears. Friction where there used to be glide. You don’t see the failure at first, you sense it. Heat building, resistance creeping in. Motion costing more than it should. That smell is information and those who know machines don’t wait for the break. They slow down, reduce load, adjust. Because when systems keep forcing movement at this stage, they don’t get progress, they get damage.

You lessen the blow by reducing speed, by shedding load, by choosing which stresses are absorbed deliberately instead of all at once by accident. You don’t save the machine by pretending it isn’t overheating. You save it by easing it into a lower gear before friction becomes fracture. That means fewer forced moves, fewer symbolic gestures, fewer attempts to extract one more turn of performance from parts that need rest or replacement.

Lessening the blow is not weakness, it’s mechanical intelligence. It’s understanding that impact is shaped long before collision, by timing, by placement, by how much momentum you carry into the wall.

At this stage, survival belongs to those who slow early, choose carefully, and let the system give up excess gradually rather than catastrophically.

What I observe now is not panic, but a profound, silent recalibration. A collective shift from the calculus of optimization to the calculus of preservation. From ambition to audit. From projecting forward to taking inventory. The questions animating the highest corridors of power have changed in character: they are no longer “What can we build?” but “What will break if we push here?” “What remains if we withdraw?” “What is irreplaceable?”

This is not the behavior of a system in collapse. It is the behavior of a system entering its endgame.

In this phase, the signals grow subtle, almost oracular. Markets begin to respond perversely to traditional stimuli like a medicine to which the body has grown resistant. It’s like we exhausted the broad-spectrum antibiotics early. We threw everything at the infection, stimulus, leverage, intervention, override. It worked for a time, but it also stripped away resilience. What remains now isn’t healing but pain management.

Morphine doesn’t cure the condition. It dulls the signal, buys time and makes the experience tolerable while the underlying system continues to weaken. When relief replaces repair, when sedation replaces diagnosis, the objective quietly shifts from recovery to delay. And delay always increases the severity of what eventually has to be faced.

The intelligence now isn’t in stronger medicine. It’s in tapering, in reducing load. Allowing feedback to return before the system forgets how to regulate itself at all. That’s how you lessen the blow…

Hedges that were meant to diverge begin to move in eerie concerto. When equities and bonds fall together, it is not a correction; it is a quiet verdict on the underlying architecture of trust. When capital migrates toward assets untouched by political promises or institutional stewardship; toward land, toward tangible commodities, or stored energy—it is not a speculative fancy. It is gravity reasserting its claim.

Trade is noisy, visible, performative. Capital is silent, capital votes with its feet, it responds only to gravity. It reduces exposure not to be reactive, but in acknowledgment of constraint. Every trade deficit has its shadow in a capital flow, and when confidence tightens, those shadows lengthen and deepen, determining outcomes far beyond the balance sheets.

This is why certain regions, certain decisions, now carry a charge disproportionate to their surface area. They are not mere policy shifts; they are pressure points near the King. In such positions, escalation is rarely chosen for gain. It is risked when the threshold of restraint is worn thin by a thousand small frictions and finally tears. And everyone at the table knows precisely how thin that fabric has become.

The atmosphere in the rooms where power now gathers is devoid of adrenaline. There is no excitement, no theatrical dread. Only the cool, clear light of calculation under constraint.

The meaningful conversations are not on stages. They occur in hushed, bilateral spaces, stripped of narrative, reduced to stark mechanics: debt trajectories, capital mobility, energy security, supply chain fragility, technological leverage, geographic choke points. These are not topics for debate. They are boundary conditions. The parameters within which all remaining moves must be made.

It’s like standing at my grandfather’s deathbed. His body was still there, breathing, technically alive, but the center of gravity in the room had already shifted. Everyone knew it, no one is saying anything, the air wasn’t heavy with mourning yet. It was heavy with assessment.

I remember watching faces more than I watched him. People spoke softly, but their attention moved elsewhere, toward each other, toward the future, toward what would follow once the anchor was gone. Succession wasn’t discussed, it was silently rehearsed. Who would step forward? Who would retreat? What would be held together, and what would quietly fall apart once no one was looking?

Nothing about it felt cruel… It felt clinical. Love didn’t disappear, it just stopped being the organizing principle. Continuity did. Exposure narrowed, old assumptions dissolved without argument. The room wasn’t waiting for death. It was already adjusting to its consequences.

That is what this moment feels like to me now. Not collapse, not chaos but the cold, sober awareness that the figure at the center no longer governs the room, even if they haven’t yet left it. In this environment, silence itself becomes a dialect. What is not said speaks volumes.

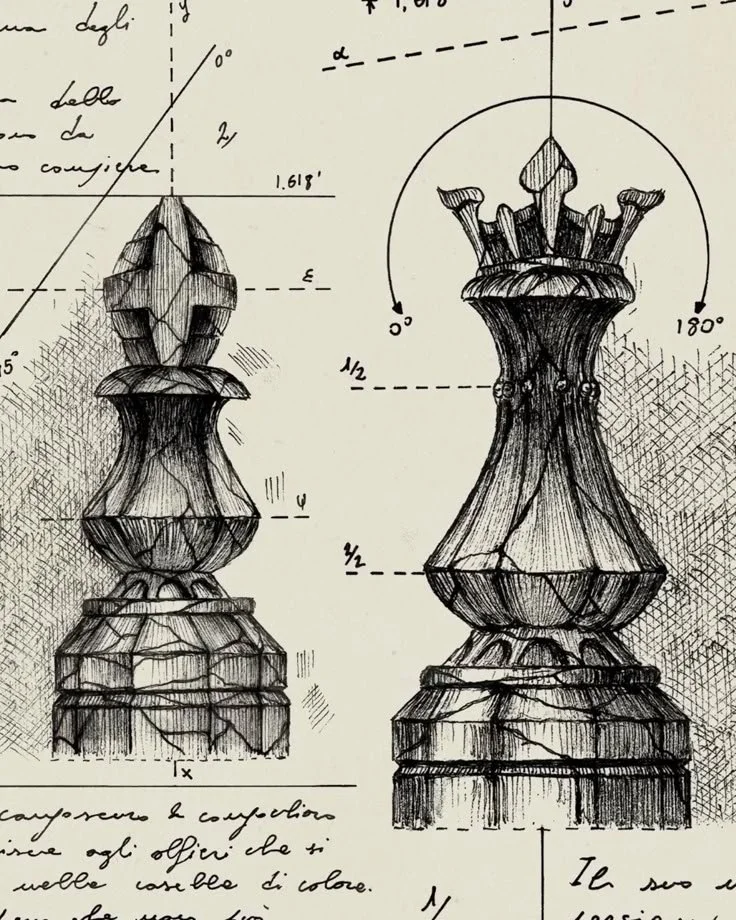

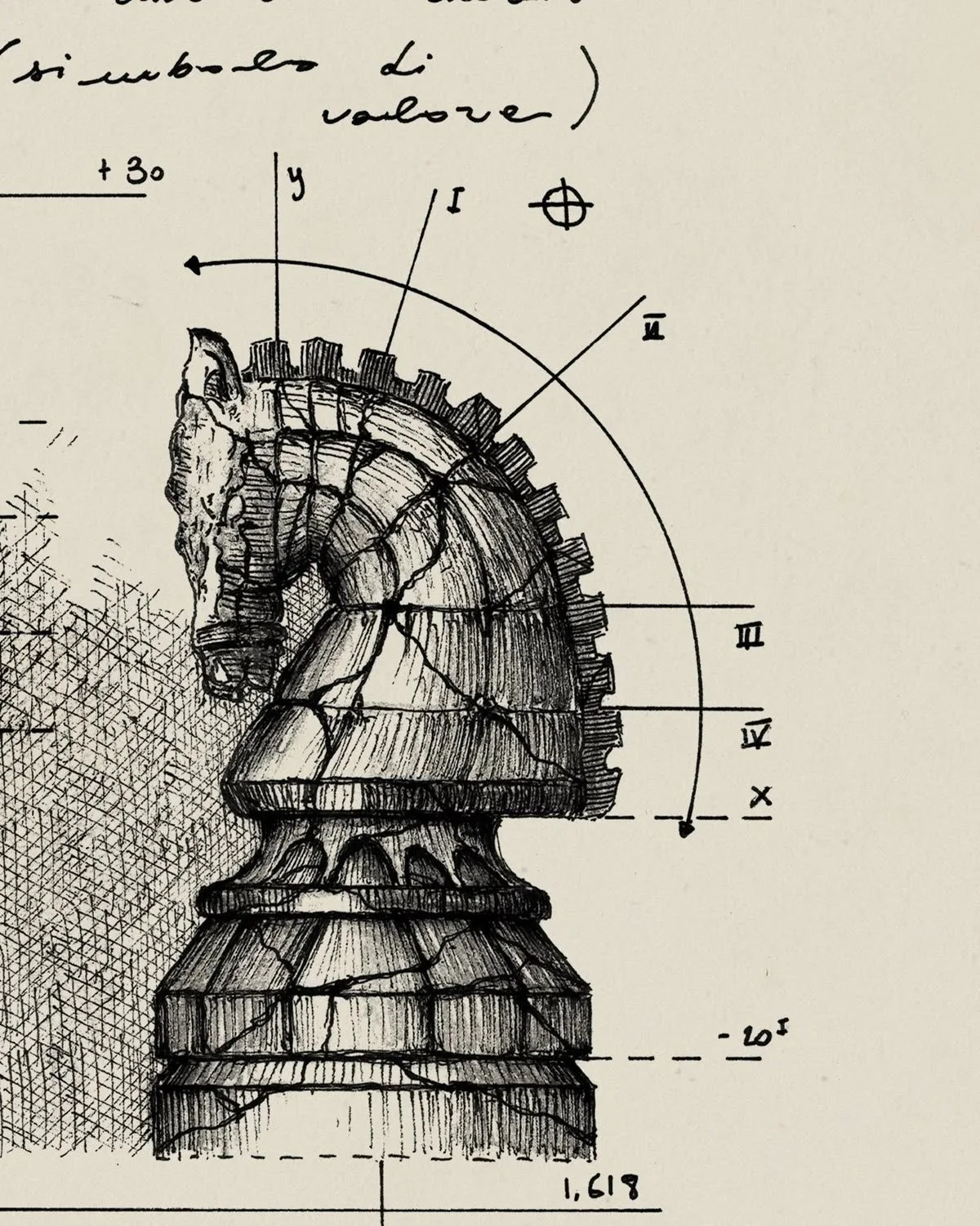

I observe, too, the weight placed upon singular, almost salvific instruments. Technology, particularly artificial intelligence is viewed as a reopening of optionality, a knight’s leap that might reset the board and restore the momentum of earlier phases.

It is potent, undoubtedly transformative. Yet in strategic terms, it remains a knight that is agile, disruptive, capable of changing tempo. It is not a rook that anchors a file, nor a queen that commands the board. It cannot fortify a weakened structure or defend the king. To lean too heavily upon a single piece, however powerful, is to reveal a disquieting scarcity of redundancy.

Late-game intelligence does not wager the kingdom on a flash of brilliance.

Zugzwang, crucially, does not mandate paralysis. It demands discernment. It is the art of distinguishing between a move that conserves leverage and one that dissipates it; between a loss that is survivable and one that is terminal; between restraint as strength and restraint as abdication. This is where many misread the moment, equating motion with leadership, mistaking activity for agency. They escalate to avoid the appearance of weakness, investing further into positions where the downside has grown grotesquely asymmetrical, because retreat feels like failure rather than seasoned judgment.

But endgames do not reward performance… They reward placement.

There arrives a moment in every long cycle when the illusion expires. Not with a bang, but through a gradual, irrevocable exposure. The mechanisms that once seemed infinite, the central banking magic, the geopolitical narratives, the faith in perpetual liquidity finally become visible. The wizard, sensing the audience’s altered gaze, chooses to reveal the apparatus. Not a trick, but a bid for applause. The spell no longer holds, and sustaining it would demand more energy than the decaying structure can now provide. So flush it down the toilet.

Systems that play deity for too long do not fail because of moral lapse. They fail because they sever their own feedback loops. They insulate themselves from consequence until consequence returns not as a lesson, but as a law. Nature’s correction is rarely dramatic. It is thorough... It operates through cycles, through limits, through the patient, inexorable erosion of that which cannot sustain itself.

Across empires, across economies, across ecologies, the pattern echoes: expansion meets boundary, excess meets counterforce, complexity collapses not into chaos, but into a simpler, starker truth- a reversion.

Humpty Dumpty sat on a wall… Humpty Dumpty had a great fall. All the king’s horses and all the king’s men couldn’t put Humpty together again.

Humpty Dumpty is a nursery rhyme we’re taught to hear as harmless, almost silly, but it’s actually a precise description of systemic fragility. A structure elevated beyond its natural balance, perched too high, too certain of its position, assuming continuity simply because it has not yet fallen.

Humpty doesn’t break because he is weak. He breaks because he is overextended. Because gravity never stopped applying its rules just because the wall felt stable for a while.

“All the king’s horses and all the king’s men couldn’t put Humpty together again” is the line most people skip past too quickly. It’s not about effort but about irreversibility. There are failures that cannot be repaired by power, by force, by resources, or by coordination. Once the balance is lost, scale cannot recreate it. Complexity cannot reverse it. Command cannot fix it.

That’s the quiet truth embedded in the rhyme. Empires fall this way, financial systems fall this way and personal identities fall this way too. Not in a single dramatic moment, but after a long period of living above feedback, above consequence, above the ground that once made repair possible.

What we’re watching now feels less like a sudden fall and more like the recognition that the wall itself was never meant to hold that much weight indefinitely. The pieces are still in place, the structure still recognizable, but the crack has already happened at the level that matters.

This is why the instinct to “fix everything” feels misplaced right now. Because some endings are not meant to be reversed. They are meant to complete. To clear space. To return material to the ground where something else can eventually be built, differently, more honestly.

The wisdom of the endgame is not how to put Humpty back together. It’s knowing when to stop trying, step back, and let what must fall, fall, so that what comes next has a chance to stand on something real.

The endgame does not belong to the forceful, but to the perceptive, to those who can read the field without flinching, tolerate ambiguity without theatrics, and understand that sometimes the most powerful move is to cede the turn, to wait while others exhaust their dwindling options.

Zugzwang is not the end of play, it is the moment play becomes honest.

From here, authority is no longer derived from dominance, nor from grand narrative. It flows from restraint, from precision, from the capacity to see the entire board and accept what it reveals, even when it contradicts the cherished stories of a bygone age.

I am watching the quiet moves now. The moves that don’t make headlines. The moves that conserve energy, preserve optionality, and maintain the very possibility of continued play. The withdrawal that is not defeat, but consolidation. The silence that is not weakness, but focus. The patience that is not passivity, but strategy.

Those moves will determine what endures this long winter of the game.

Not speed, brilliance, or force. But placement.

And in this rarefied, contracted air of the endgame, placement is not merely important.

It is everything.

Xo, C